The Lender Invest platform facilitates interaction between private and corporate investors and small and medium-sized business entities, providing the former with the opportunity for passive income and the latter with access to financing for business development. The service connects parties in a digital environment, focusing on optimizing investment processes and supporting entrepreneurial initiatives.

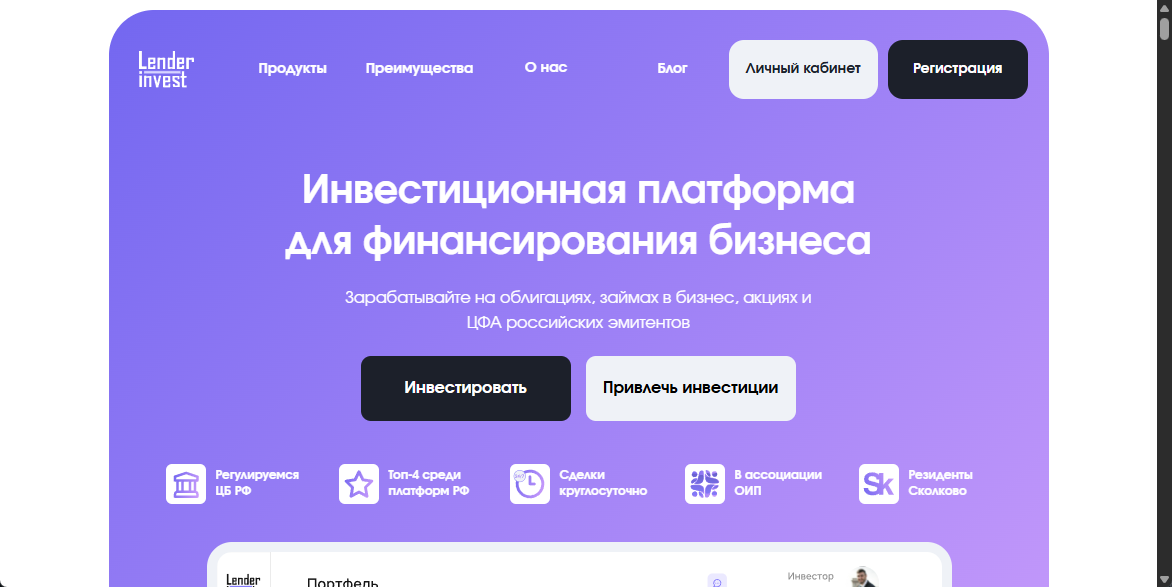

The website lender-invest.ru supports the Russian language, but additional localizations are currently not available. The visual design of the main page is presented in the attached image.

According to the resource, the service operates under the supervision of the Central Bank of the Russian Federation since August 2019, confirming its compliance with established regulatory standards. The head office, internal documentation, and contact details are presented at the bottom of the resource.

Declared Profit from Investments in «Lender Invest»

The company provides clients with a wide range of financial instruments aimed at diversifying investments and minimizing risks. The list of key products includes:

- Debt markets – participation in primary placements of corporate bonds and exchange-traded debt instruments.

- Digital innovations – using smart contracts to automate investment processes and manage digital assets.

- Early stages of business – access to shares of promising companies before they go public (Pre-IPO).

- Corporate solutions – arranging revolving loans for legal entities through specialized marketplaces.

- Operational support – financing current business needs aimed at expanding and stabilizing their activities.

The minimum amount to start investing is 30,000 rubles with a declared return from 24% to 36% per annum and investment terms from 30 days to 12 months. The platform supports the auto-investing function, allowing for various capital management strategies.

A separate offer highlights the «Capital Protection» strategy with a fixed yield of up to 32% per annum. Participation requires a minimum deposit of 100,000 rubles and a term of at least 7 days.

The company provides entrepreneurs with access to loan financing with a simplified registration procedure. To receive funds, the borrower must meet a number of requirements, including having a guarantor, an annual turnover of at least 90 million rubles, a business duration of at least 12 months, and providing a bank statement for the last period.

Depositing and Withdrawing Money from lender-invest.ru

The «Lender Invest» platform provides clients with the ability to conduct financial transactions through the fast payment system (FPS) and payment by details. The timing of funds being credited to the deposit is not specified, while the withdrawal of funds is carried out within three business days. Information about minimum and maximum withdrawal limits is absent. Details about possible commission fees and conditions of the used payment methods are also not disclosed.

Conclusions About the Investment Company lender-invest.ru

The lack of transparent information about the main terms of cooperation may raise questions for potential clients. It is recommended to study reviews about Lender Invest to get an objective view before starting interaction.

Arina88

I don't like the format in which the Lender Invest project operates, but due to persistent advertising and numerous positive reviews, I decided to use their services. As a result, I not only wasted a huge amount of time and nerves, but also ended up paying almost twice as much. I regret not reading the reviews online before contacting them, and now I terribly regret it…

Денис Бочаров

At first glance, the idea of the project sounds great, but the problems begin at the stage of implementation. In fact, they turned the "noble idea" into straightforward loans with an initial payment and exorbitant interest rates. It doesn't differ much from working with payday lenders. It's better not to use their services if you don't want to struggle with repayments later.