Investment markets attract not only investors but also various schemers. Fake brokers are false investment companies whose goal is to extort money from unsuspecting users. They offer high returns, promise minimal risks, and full support. However, their main goal is to seize clients' funds. Let's explore how to distinguish them, what schemes they use, and how to protect yourself from fraud.

Scam brokers take advantage of trust and the lack of victims' knowledge about financial markets. Their main goal is to get hold of the investor's money. Such pseudo-investment organizations offer to open an account on their platform, promising access to unique investment tools. They offer high returns and professional support. However, instead of the promised income, investors receive only disappointment and an empty wallet.

Clients are often shown fake profits on the platform to encourage them to invest more. When a user decides to withdraw money, scammers demand payment of fees, insurance, or taxes. In the end, the funds are never returned.

Signs of Fraudulent Brokers

How to distinguish a scam broker? This can be done by several characteristic signs.

Lack of a license. Reliable organizations operate under the control of regulators. Counterfeit intermediaries usually avoid checks, so their licenses are either absent or fake. You can verify the authenticity of a certificate on the regulator's website.

Intrusive advertising and calls. They may also actively use aggressive marketing strategies.

The client may be called with persistent offers to invest money, promising large returns in a short time.

Non-payment of Profit – Scam Brokers' Trick

Promises of guaranteed profit. Real investments are always associated with risks. Promises of stable income without losses indicate fraud.

Difficulty withdrawing funds. The main indicator of fraud is the inability to withdraw money. Intermediaries demand payment of fees, taxes, or insurance before withdrawal.

Negative reviews. Before starting cooperation, it is worth paying attention to reviews about the brokerage company. If it becomes clear from them that clients often encounter problems withdrawing funds, this is a clear danger signal.

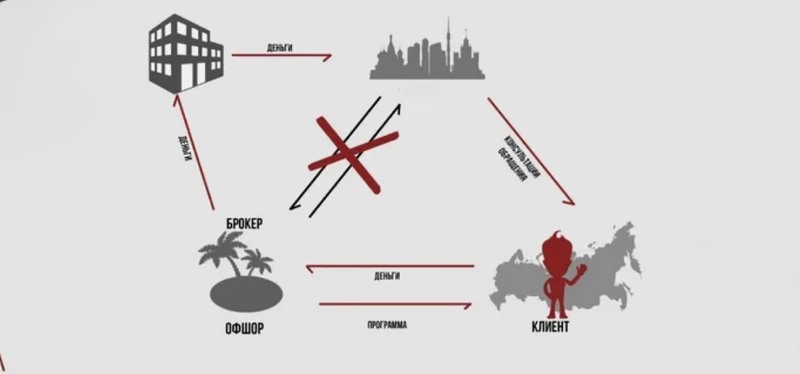

Popular Fake Broker Schemes

Fake brokers use various methods of deception. There are several of the most common schemes.

«Fake Platform». The client registers on a fake site and starts «trading». The balance on the platform grows only virtually, while the money goes to the fraudsters.

«Secure Account». The scammers convince the client to transfer money to a special «protected» account to prevent losses.

«Expert Trader». The schemers assign the client a «personal manager» who supposedly manages the funds. After the money is deposited, contact with this person ceases.

To avoid financial losses, it is important to follow basic precautionary measures. Here are some recommendations:

- License information should be available on the company's website. Its authenticity can be verified on the official resources of financial regulators. For example, in Russia, it's the Central Bank of Russia, in Europe — CySEC or FCA.

- Before starting work with an investment firm, find reviews on independent platforms. A large number of negative comments is a reason to refuse cooperation.

- Exaggerated profit guarantees — one of the signs of scam brokers. Reliable trading representatives never make such promises. Offers that are too enticing are a clear sign of deception.

- Never disclose passwords or codes to third parties, even if company representatives demand it.

It is recommended to cooperate with financial companies that have been operating in the market for many years and have a positive reputation.

What You Should Know About Fake Brokerage Firms

Deceptive investment brokers are a serious threat to those who want to invest their funds. Fraudsters continue to profit from the trust and lack of knowledge of investors. Their actions are becoming more sophisticated, so it's important to be vigilant and check each potential partner.

Remember that guaranteed profits in financial markets are a myth, and promises of quick returns with minimal risks often indicate fraudsters. Study the information, verify licenses, and avoid suspicious offers to protect your finances.

Investment markets attract many people looking to increase their capital. However, along with legal platforms, there are fraudulent organizations whose goal is to deceive clients and take their money.

Understanding the signs of such brokers and knowing precautionary measures can help protect your investments. Awareness and caution are the key factors that help avoid financial losses.