Cryptocurrency exchange directly between users has become a convenient alternative to centralized exchanges. It's simple: find a person, agree on a rate, make the deal, and get the money. Fast, without intermediaries and formalities. But it is in this 'simple' scheme that the threat lies — scam deals in the P2P space are becoming more sophisticated.

Scammers adapt to the trading format, disguise themselves as honest participants, and extort money or cryptocurrency. Most often, the deception occurs where everything looks too smooth: perfect reviews, pleasant communication, a profitable rate. But at some point — a break in communication, a dispute on the platform, or frozen funds. P2P cryptocurrency exchange ceases to be profitable if one mistake is made.

How P2P Exchange Works and Where Fraud is Most Common

P2P trading (peer-to-peer) is a way to buy and sell cryptocurrency without intermediaries. Users agree directly, and the platform only helps: it can secure assets, initiate arbitration in case of a dispute, and track the transaction. But if the deal goes beyond the platform or basic security rules are violated — fraud is almost inevitable.

Crypto scams in the P2P format often look harmless. For example, they send you a screenshot of a payment, rush you to confirm, or ask to switch to a messenger 'for convenience.' And then — either the transfer is canceled, or the person completely disappears. Some even use fake documents to convince you of their 'reliability.'

It is important to understand that even the most popular platform cannot fully secure a deal if the participants themselves take risks. Platforms only provide tools, but how to use them is up to the person.

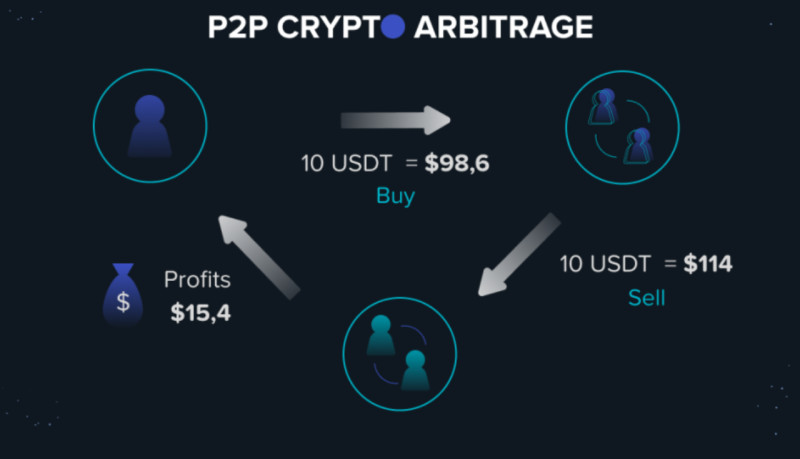

How Scams Occur in P2P Deals

Scams are becoming increasingly difficult to recognize. The same scammer can operate under different names, from different accounts, and with fake reviews. And each time, their goal is to create the appearance of an honest deal to lull vigilance. They won't be rude or pushy — on the contrary, they will offer 'the best conditions' and be as polite as possible. In practice, such schemes work more often than it seems. Here is a list of popular methods used by scammers in P2P exchanges:

- send fake payment receipts or screenshots;

- cancel bank transfers after receiving cryptocurrency;

- use accounts with inflated reviews and ratings;

- suggest moving the deal to messengers or off-platform;

- pressure urgency: 'the rate is changing,' 'I'm in a hurry,' 'the platform is slow';

- request a prepayment or 'insurance fee' before the deal;

- ask for personal data supposedly for 'identity verification.'

Even one of these signs should raise a red flag. Do not take words at face value if the stakes are too high. Scam deals are often built on trust, which is artificially created — with quick responses, beautiful words, and a fake success story.

After being scammed, it is almost impossible to recover cryptocurrency. Blockchain is irreversible, and banks do not always assist with reversing a transfer, especially if it is confirmed. That's why it's better to anticipate possible scam scenarios than to deal with the consequences later.

What Helps Protect Against Fraud

Verification, analysis, and caution are the three main tools in P2P trading. The first line of defense is to use only platforms that provide a funds-locking function at the time of the deal. This eliminates situations where cryptocurrency is sent before receiving money.

It is also important to analyze the participant's profile — reviews, registration date, transaction frequency. If everything looks too fresh or suspiciously ideal — it's time to be cautious. Safe trading requires a sober approach, especially if large sums are involved.

Avoid any form of pressure and manipulation. Promises of 'guaranteed profit' or convincing that 'everyone does it this way' are signs of potential fraud. Safety in P2P trading starts with a simple rule: trust but verify.

If there is uncertainty in the deal — it is better to pause the process and contact support. Sometimes a simple question about why the interlocutor insists on changing the platform helps preserve funds. And if they start to justify themselves or become aggressive — that's already a warning sign.

What Else to Pay Attention To

Visual and behavioral signs of crypto scams should not be ignored either. Lack of public profiles, vague wording, inconsistencies in details — all of this should raise alarms. Even if the deal seems profitable, it's important to ask yourself: 'Why are they offering these conditions to me specifically?'.

Some scammers act very subtly. They don't rush, conduct negotiations politely, and can even show fake documents. But if you look closely — you may notice that their story doesn't add up or that there is no logic in their actions. It's always helpful to ask a few clarifying questions — about the deal scheme, the source of the cryptocurrency, the platform.

P2P cryptocurrency exchange offers freedom, but with it comes responsibility. Any mistake can be costly. Therefore, the more carefully a participant approaches the deal, the higher the chances of preserving assets. And in conditions where scams are becoming more sophisticated, this is especially important.