Forex has long been an attractive topic for those looking for a quick way to make money. The difference in currency rates, constant market fluctuations — all this looks like a chance for a smart investor. But dangers are easily hidden behind opportunities. First and foremost — fraudulent brokers who exploit the gullibility of users for their own interests. If you do not recognize the trick in time, you can quickly lose all your investments.

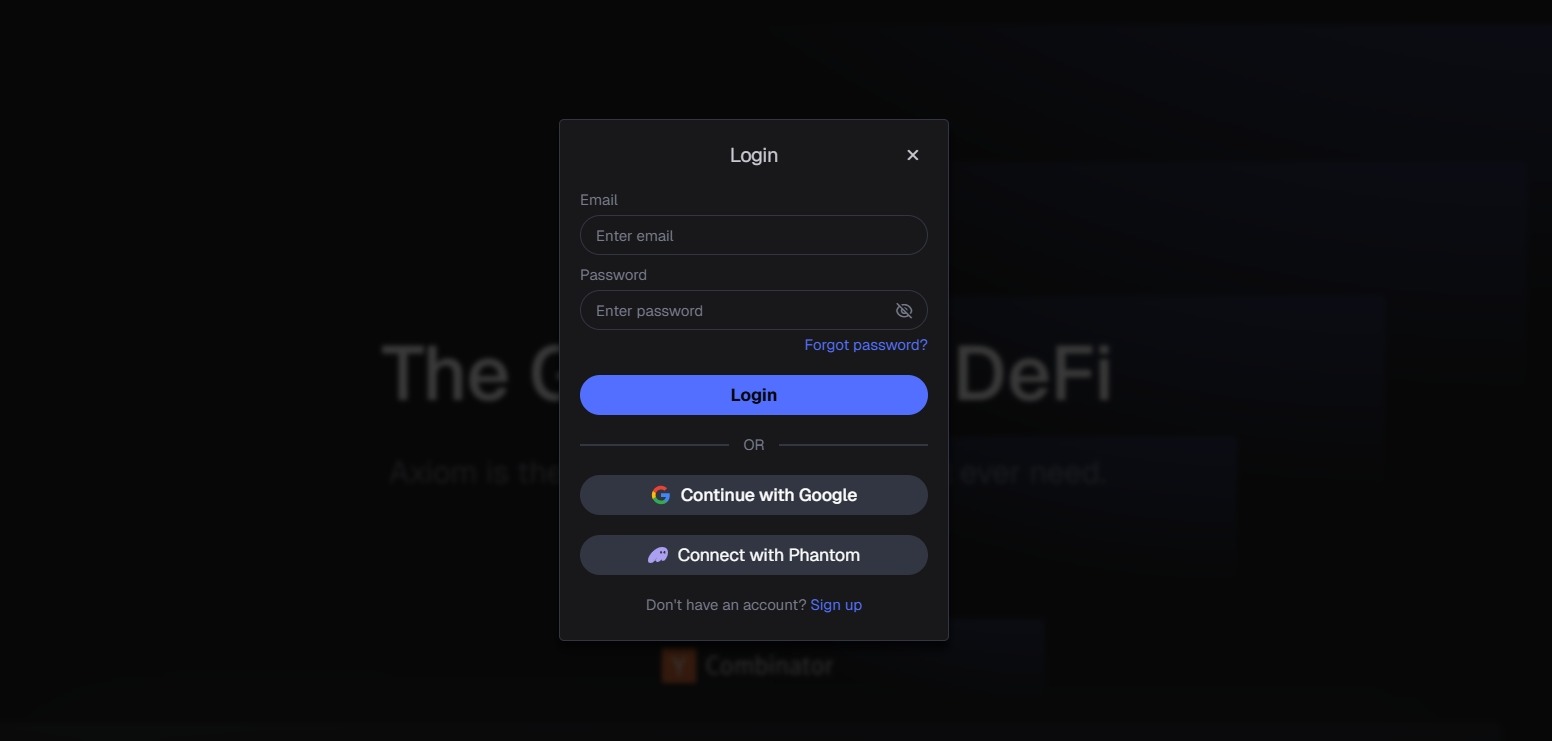

Under the guise of an honest platform, an ordinary forex scam may be hiding: a site with a beautiful interface, «successful» traders in reviews, and promises of stable profit. In reality — no licenses, no guarantees, and instead of trading, there is a banal money siphoning. Realizing that you are facing deception is not always easy. Especially if everything looks convincing and professional, and a «manager» contacts you, confident in every word.

How they deceive through forex

Fraudsters always start the same way: a call, letter, or advertisement urging you to «invest in a profitable market». Then — quick registration, a personal manager, and «profitable» offers. Everything is built on creating trust, and it is at this stage that the victim makes the first transfer.

At first, they ask to deposit a small amount — «just to try». After this, aggressive persuasion to top up the account more, promising that «everything is under control». When the client asks to withdraw the money, problems begin. Verification is required, commissions are invented, technical difficulties are referred to. And, eventually, they disappear.

Sometimes the risks of trading are masked as «market volatility». In reality, the money is drained through fake trades. Some platforms even fake charts and results — so that the client does not notice the trick. And if suspicions arise, the account may simply be blocked under the pretext of an «internal check». As a result, the victim loses not only money but also the ability to legally protect themselves.

What should alert you

You can detect fraud even before funding the account. You just need to look closely. Often fraudulent brokers operate without licenses or issue fake documents. Their sites may look expensive, but do not contain legal information, real addresses, or staff names. Transparency of conditions and a clear description of risks may also be missing. Suspicious signals can also be:

- intrusive calls and «hot» offers;

- promises of guaranteed returns;

- lack of a contract or complex, vague terms;

- inability to contact support directly;

- pressure with a demand to urgently top up the account.

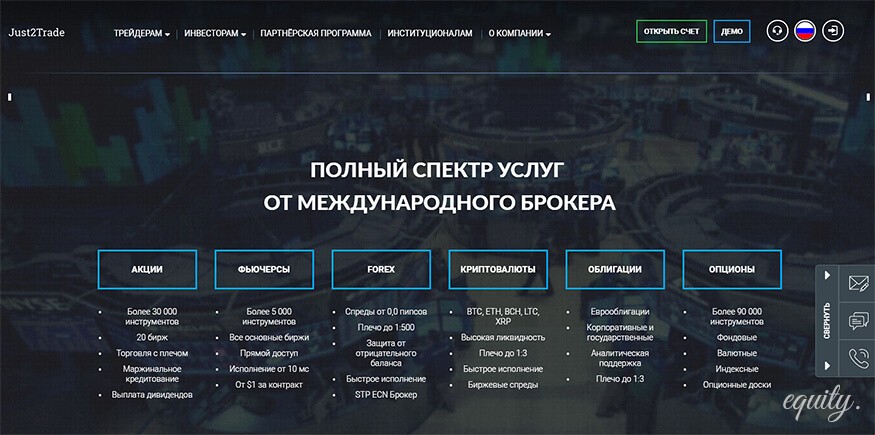

Before trusting your money, it is important not to rush. Real companies do not need aggressive sales and do not promise instant profits. Their operations are transparent, understandable, and documented. Even the website design and platform structure can say a lot about the company's integrity.

How to avoid forex scams

The most reliable — is verification. Even simple steps can protect against losing money. Before you start trading, it is worth:

- finding the broker in the financial regulator's register;

- ensuring the company has a license (for example, from FCA, CySEC, or ASIC);

- studying reviews not on the broker's website, but on independent platforms;

- checking if the name is mentioned in lists of suspicious companies;

- checking the conditions for withdrawing funds and actual commissions;

- assessing the company's activity: is there a team, news, contacts.

These actions do not take much time, but can save you from losses. It is especially important to check everything yourself, and not to trust screenshots or the words of «managers». No honest broker will hide their documents or refuse to explain how their platform works.

Even if the company offers P2P cryptocurrency exchange or works with crypto assets — security standards remain important. Lack of transparency, closed platform code, and absence of checks — all these are potential signs of crypto fraud.

What to do if fraud has already occurred

If the money has already been transferred, but difficulties arise — it is important to act as early as possible. The first — stop depositing additional funds. The second — record all correspondence, account screenshots, and transaction history. With this data, you can contact the cyber police, financial regulator, and, if necessary, court.

Unfortunately, it is not always possible to recover the funds. But if the fraud is documented, there is a chance. It is also important to share your experience — on forums, social networks, on review platforms. This will help others avoid the trap. The more people know how scam deals work, the less room fraudsters have to maneuver.